Which of the Following Provides Medicare Supplement Policies

If you join a Medicare Advantage Plan the plan will provide all of your Part A Hospital Insurance and Part B Medical Insurance coverage. OUTLINE OF INDIVIDUAL MEDICARE SUPPLEMENT PLAN COVERAGE Benefit plans A D F High Deductible Plan F Innovative Plan F Plan G High Deductible Plan G Innovative Plan G and N are offered by Health Net Life Insurance Company HNL Medicare supplement insurance can only be sold in standard plans.

When Turning The Age 65 Many Seniors Enroll In Original Medicare Part A And Part B Par Home Health Services Medicare Supplement Plans Skilled Nursing Facility

Medicare Supplement insurers must offer you a policy if you lose coverage under one of the following types of health plans and you apply for a Medicare Supplement policy in Maine within 90days.

. Medicare Advantage Plans sometimes called Part C or MA Plans are offered by private companies approved by Medicare. Medicare provides limited sexual health coverage for beneficiaries. C Each standardized Medicare supplement policy must cover the basic benefits.

Medicare Part B does not require a coinsurance so no additional coverage is needed. A Medigap policy is different from a Medicare Advantage Plan. As you can see Medicare Plan A is the most basic of the 10 Medicare Supplement insurance Medicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare Medicare Part A and Medicare Part B health insurance coverage.

B Medicare Plan B provides coverage for skilled nursing facility care and at-home recovery care. Learn about the 2 main ways to get your Medicare coverage Original Medicare or a Medicare Advantage Plan. Medicare Supplemental Insurance Medigap.

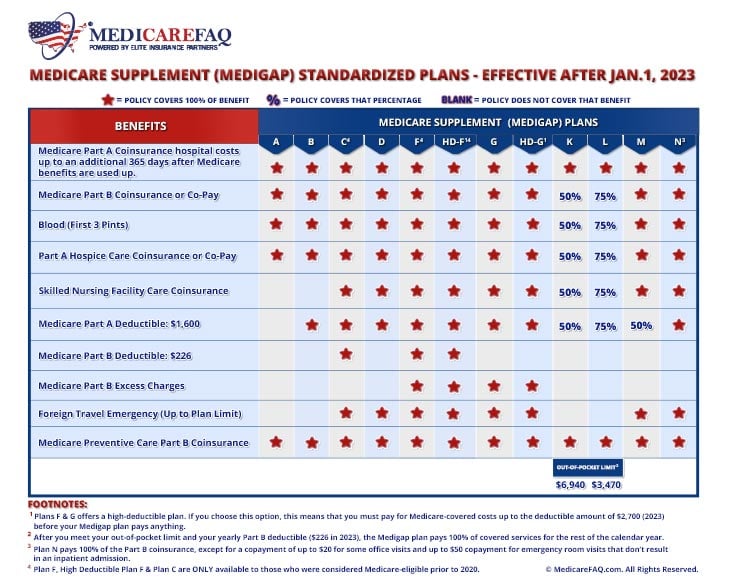

OUTLINE OF MEDICARE SUPPLEMENT COVERAGE Benefit Plans A B C D E F H I and J These charts show the benefits included in each of the standard Medicare supplement plans. Medicare and Medigap Alzheimers Coverage. Medicare coverage for many tests items and services depends on where you live.

If you have Original Medicare and a Medigap policy Medicare will pay for its share of the Medicare approved amounts for all covered health care costs. Medicaid is a state-funded program that provides healthcare to persons over age 65 only. The Omnibus Budget Reconciliation Act of 1990 requires that large group health plans must provide primary coverage for disabled.

Medigap Medicare Supplement Health Insurance A Medigap policy is health insurance sold by private insurance companies to fill the gaps in Original Medicare Plan coverage. Medigap Plans Work Alongside Original Medicare. A Medicare supplement policy that provides only the basic core benefits is known as.

20 For which of these policies is the individual allowed to deduct the premiums they pay that exceeds 75 of their adjusted gross income. Those plans are ways to get Medicare benefits while a Medigap policy only supplements your Original Medicare benefits. Only a Long-term care policy will cover Medicare Part B coinsurance b.

Plans that offer Medicare drug coverage are run by private insurance companies that follow rules set by Medicare. Medicare provides some coverage for Alzheimers Disease treatments. Which of the following provides coverage on a first-dollar basis.

Which of the following describes coverage for the Medicare Part B coinsurance. Learn what important treatments services and devices are covered and which ones arent. You pay the private insurance company a monthly premium for your Medigap policy.

Original Medicare A Medigap policy is private health insurance that supplements Original Medicare. Which of the following statements about Medicare supplement policies is CORRECT. Having a Medicare Supplement policy can provide financial stability by helping you pay Medicare-approved expenses and works together with Medicare to provide more insurance coverage.

A Medicare Supplement Policy must include as a core benefit Medicare Part B coinsurance in the amount of _____. 6 months following the effective date of coverage. Your Medicare coverage choices.

A Medicare Plan A provides coverage for skilled nursing facility care. All of the following individuals may qualify for Medicare health insurance benefits EXCEPT. You must have Medicare Part A and Part B.

All of the following statements concerning Medicaid are correct except. Policies are standardized and in most states named by letters like Plan G or Plan K. Which of the following is not covered under part B of Medicare policy.

Plans but its coverage should not be underestimated. An Individual health insurance plan not including fixed indemnity or short-term. Benefits will not be excluded if as of.

There are 10 standardized Medigap plans in most states and each provides its own level of coverage. In the event of a loss business overhead insurance will pay for. Medicare Advantage Plans may offer extra coverage such as vision hearing.

You pay this monthly premium in addition to the monthly. Consider the following before you choose one of our Medicare Supplement or Medicare Select products. Medicare advantage is also known as.

Extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare. To offer other Medicare Supplement plans during this period. This list includes tests items and services covered and non-covered if coverage is the same no matter where you live.

You do not need more than one Medicare Supplement policy or certiicate. A Medicare Supplement optional benefit c. Then your Medigap policy pays its share.

A Plan A B Plan F C Plan G D Plan J. A Medicare Supplement. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesnt cover.

Included in A-J Plans. A retired person age 50. All of the following statements about Medicare supplement insurance policies are correct except.

A Medicare Supplement core benefit d. If you are in the Original Medicare Plan and have a Medigap policy then Medicare and your. Every company must make available Plan A Some Plans may not be available in North Carolina.

Medigap can help cover some costs for treatment and necessary long-term care. If you purchase this policy you may want to evaluate your existing health coverage and decide if you need multiple coverages. Medicare Supplement Insurance also called Medigap plans help cover certain Medicare out-of-pocket costs such as deductibles coinsurance copays and other fees.

Turning 65 7 Common Questions And Answers About Medicare Medicare Supplement Health Plan Medicare Advantage

Medicare Supplement Plan Medicare Supplemental Insurance Medigap Medicare Supplement Medicare Supplement Plans Medicare

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

Medicare Supplement Vs Medicare Advantage Medicare Retirement Advice Social Security Benefits Retirement

Medicare Choices Medicare Medicare Advantage Medicare Supplement

Medicare Plan B Medigap Plan B Medicare Supplement B Medicare Supplement Plans Medicare Supplement Best Health Insurance

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

Medicare Plan N Medigap Plan N Medicare Supplement Plan N Medicare Supplement Medicare Medicare Supplement Plans

Does Medicare Cover Affordable Health Insurance Private Health Insurance Affordable Health

Here Are The Major Benefits Of A Medicare Supplement Policy Conveniently Outlined In An Infographic Medical Services Medicare Supplement Infographic

Do You Need Medigap Plans These Expert Shared Their Views Medicare Medicaresupplement Medigap Retirementexperts Medicare Medicare Supplement How To Plan

How To Choose Between Medicare Supplement Plans F G Or N Medicareguide Com

Compare Medigap Plans Comparison Chart For 2021 Medicarefaq

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

Medicare Advantage Vs Medicare Supplement Medicare Advantage Plans Are Offered By Private Insu Medicare Advantage Medicare Supplement Medicare Supplement Plans

Gomedigap Offers All Medicare Supplement Plans From 30 Different Insurance Companies We Provide Free Medicare Supplement Medicare Supplement Plans Medicare

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

Comments

Post a Comment